Identity Intelligence for Africa

Africa’s Identity Intelligence Layer

Real-time KYC, RBZ credit decisions, and payroll intelligence designed for serious banks, fintechs, and lenders across Zimbabwe and the continent.

Infrastructure

API-first, observability-led, multi-tenant.

Security

Encrypted evidence, SIEM-ready, audit trails.

Compliance

RBZ + SSB policies enforced from day one.

Why institutions choose EyeD

Built for Zimbabwe origination flows, our platform swaps manual friction for rapid decisions without sacrificing control.

Identity Intelligence

- Device fingerprinting + reuse detection

- Borrower history graph

- Cross-case alerting

Regulatory Control

- RBZ credit registry lookups

- SSB payroll reconciliation

- Civil servant policy flows

Experience Engine

- Hosted verification widgets

- Policy-driven approvals

- Intent-based routing

How EyeD operates

Every flow is instrumented for weak signals, duplicates, and regulatory checks.

Capture

Secure ID + selfie capture with encrypted transport and device intelligence checks.

Enrich

Duplicate detection, RBZ credit registry lookups, and payroll attestations fill the graph.

Decide

Policy automation, risk scoring, and SIEM-ready logs steer instant approvals.

Signal

Webhooks and dashboards feed your fraud and compliance teams with contextual intelligence.

Trusted resources

Security & compliance

Key rotation, crypto standards, and emergency revoke runbooks for auditors.

Open document →Developers & API

API catalog, webhook hooks, and policy automation guides for engineering teams.

Open document →RBZ + SSB integrations

Deeper details on our verified integrations with local registries.

Open document →Live in production

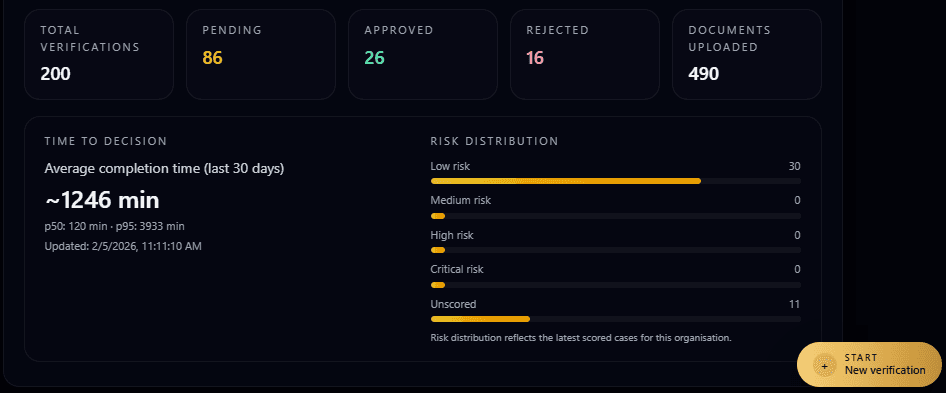

EyeD dashboards in action

One premium gallery—six operational views, one image at a time with bold captures, arrow navigation, and hover motion.

Org metrics dashboard

Top-of-funnel KPIs: volume, approvals, and risk distribution that prove your operations move fast.

Start with a pilot

EyeD connects to your stack in days, not months, and proves value before you scale.